あなた自身の 12 か月のモンキー: ヘイズ、ジーン: 9781452806242: オークション ウェブ サイト コム: 本

January 11, 2025オンライン ブラックジャック トーナメント ブラックジャック コンペティション 2024 をプレイする

January 11, 2025Citadel Borrowing Union Reinforces Dedication to The brand new Teams It Serves Compliment of Lingering Initiatives In the midst of Went on Development

Express this informative article

EXTON, Pa. , /PRNewswire/ — Citadel Borrowing from the bank Commitment was reinforcing its dedication to giving support to the groups they provides across the Chester , Dollars , Delaware , Montgomery , Lancaster , and you can Philadelphia counties owing to ongoing area initiatives.

For the 2nd successive 12 months, Citadel is actually recognized as “Greatest Borrowing Union” inside the Montgomery Condition on 2023 Happening Listing because of the Montco Activities, and you may was acknowledged from the Daily Regional News’ 2023 Best of Chester Condition Reader’s Selection prize. Each other honors depend on voting off local owners. Citadel personnel have also for the choosing end several times of Horizon The present Millennial A-listers 40 Around forty awards.

When you look at the , Citadel formalized its business providing and you may volunteer system, Citadel Cares, which have a commitment of over $dos billion next 4 decades and you will 700 hours of staff member volunteerism logged so far. Which have a currently solid track record of giving back into the newest community, brand new discharge of Citadel Cares allows the financing Union to encourage and you can support those who work in need along the Higher Philadelphia city because of the contributing to four trick elements: Degree & Childhood Prosperity, Health & Fitness, Strengthening & Creativity, and you may Eating Safeguards. Led from the these pillars, Citadel Cares will bring opportunities towards the Credit Partnership, their group, and you may members to offer back in the latest spirit of creating Stamina To each other owing to contributions, has, volunteerism, contribution pushes, and you may sponsorships off charity occurrences.

- $292,000 for the Youngsters’ Hospital off Philadelphia’s Malignant tumors Center

- $sixty,000 for the provides so you can regional instructors and school districts through the Citadel Heart out-of Studying program

- More than $37,000 so you’re able to United Way

- $forty,000 in order to Neighborhood Volunteers within the Treatments

- $20,000 toward Chester Condition Dinner Bank

- $a dozen,five hundred to An excellent Really works

- Over 700+ volunteer hours out of group

News provided with

Afterwards in 2010, Citadel will be the exclusive presenting recruit to own CHOP’s Parkway Work at & Walk as an element of a multi-year union. Citadel is even a dynamic fellow member on Montgomery County Monetary Reality Reasonable, the new Philadelphia Monetary Scholars Entrepreneurship Workshop system, and the Earliest Front door (FFD) and you may Earliest Entry way Keys to Guarantee (Keys) loans. As part of Citadel’s commitment to financial literacy, the firm appear to posts free webinars to educate viewers to the mortgage financing and using. Citadel happens to be working to develop their webinar collection to provide even more subject areas towards the monetary degree.

During the , Citadel will announce the fresh new winners of our own Heart out of Studying Prize, certainly one of their longest-standing attempts. Come 23 years back together with new Chester Condition Advanced Tool (CCIU), the application understands regional instructors from the Higher Philadelphia teams Citadel serves who inform you work for the and you can outside of the class room. Awards commonly complete $sixty,000 for the effective educators in your neighborhood and additionally an effective mug cardio prize for every champ. Once the program’s the start, more eight personal loans for bad credit West Virginia hundred instructors was in fact recognized out of tens and thousands of annual distribution, and over $410,000 could have been granted in the teacher features. Citadel’s Cardiovascular system out of Understanding Award Program are a representation of its commitment to serving people who functions day-after-day to construct a good ideal upcoming for everybody.

“Given that signing up for Citadel when you look at the later 2023, I have been proud becoming an integral part of the fresh new team’s constant operate to attain increases and balance whenever you are increasing Citadel’s presence from inside the our very own groups,” said Statement Brownish , Chairman and you may President, Citadel Credit Connection. “Our very own desire in 2024 is going to be available, reasonable, and you can convenient for all those out of The southern area of Pennsylvania also to incorporate business conversion supply top feel, finest beginning, and sleek techniques off end to end while continuous our very own historical responsibilities to corporate responsibility and you may strengthening financial strength inside our organizations.”

Progress & Balances When you look at the 2023, Citadel’s assets increased $228 mil to $5.8 million-a 4.1 percent boost. Throughout the year, Citadel continued to have solid put increases on dos.5% % from the earlier year. Mortgage gains achieved energy too, growing 4.dos per cent seasons-over-seasons. YoY money expanded $205 mil and you can deposits grew $116 million .

Completely noted from the 2023 Yearly Statement, Citadel experienced a beneficial 20-12 months collective annualized growth rate (CAGR) off twelve % anywhere between 2003 and 2023. Over the past 36 months, Citadel’s complete house increases is $1.5 million . While the 2005, Citadel knowledgeable their greatest progress-over $4.eight million inside the possessions, just like the company has exploded so you’re able to serve brand new larger Better Philadelphia area beyond their early origins into the Chester County .

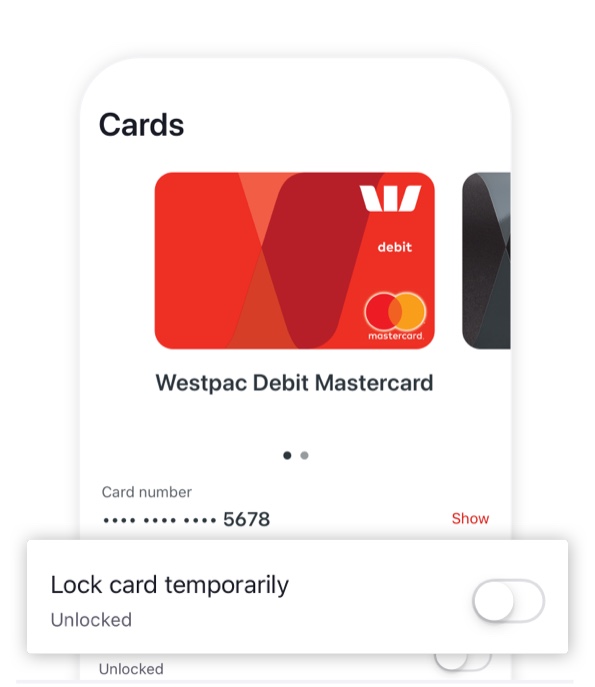

That have additions including tailored dashboards, totally free credit history keeping track of, custom membership notification, cards regulation, and you will financial health equipment, Citadel current its On the web & Mobile Financial platform directly into allow it to be more relaxing for professionals to help you would the profile.

Citadel as well as stretched the va prospective beyond sound phone calls so you’re able to become online chatbot abilities with the CitadelBanking and in this On the internet & Mobile Banking. Users may now ask questions of virtual assistant, Adel, rating answers, while a lot more help is needed, Adel can also hook up pages so you can a Citadel member thru alive talk or clips cam throughout regular regular business hours. As the release, Adel taken care of immediately a total of 83,000 member chats during the 2023, coming down call quantities, hold off times, and you can making it possible for Citadel group to blow longer you to-on-you to definitely with members who have more difficult demands.

Such improvements was an essential part of your own Credit Union’s proper propose to render membership with an increase of digital gadgets and easy, secure a way to availableness the username and passwords.