Chances of Bringing Declined Immediately after Pre-Acceptance And you may What you should do

January 10, 2025Quick Strike Platinum Casino slot games Free Without Install

January 10, 2025How does the fresh USDA Mortgage Processes Works?

In this article

- USDA Financial Qualifications

- USDA Financial Processes

- USDA Mortgage Approval

We’ve been these are USDA mortgage brokers much with the Moreira Cluster Blog site not too long ago. He is both missed of the home buyers-and also particular loan providers-since a beneficial alternative. Provided the consumer as well as the family meet the requirements, the fresh new loans can be awarded having around 100% capital (zero down payment). At exactly the same time, individual home loan insurance policies (PMI) could be minimal and rates of interest usually are top compared to the antique fund and other very first-time customer applications such as FHA funds and Va financing.

Contrary to popular belief, providing good USDA financing is much like getting virtually any home loan. The procedure is basically the exact same. The loan product alone only has its own laws and requires.

USDA Mortgage Eligibility

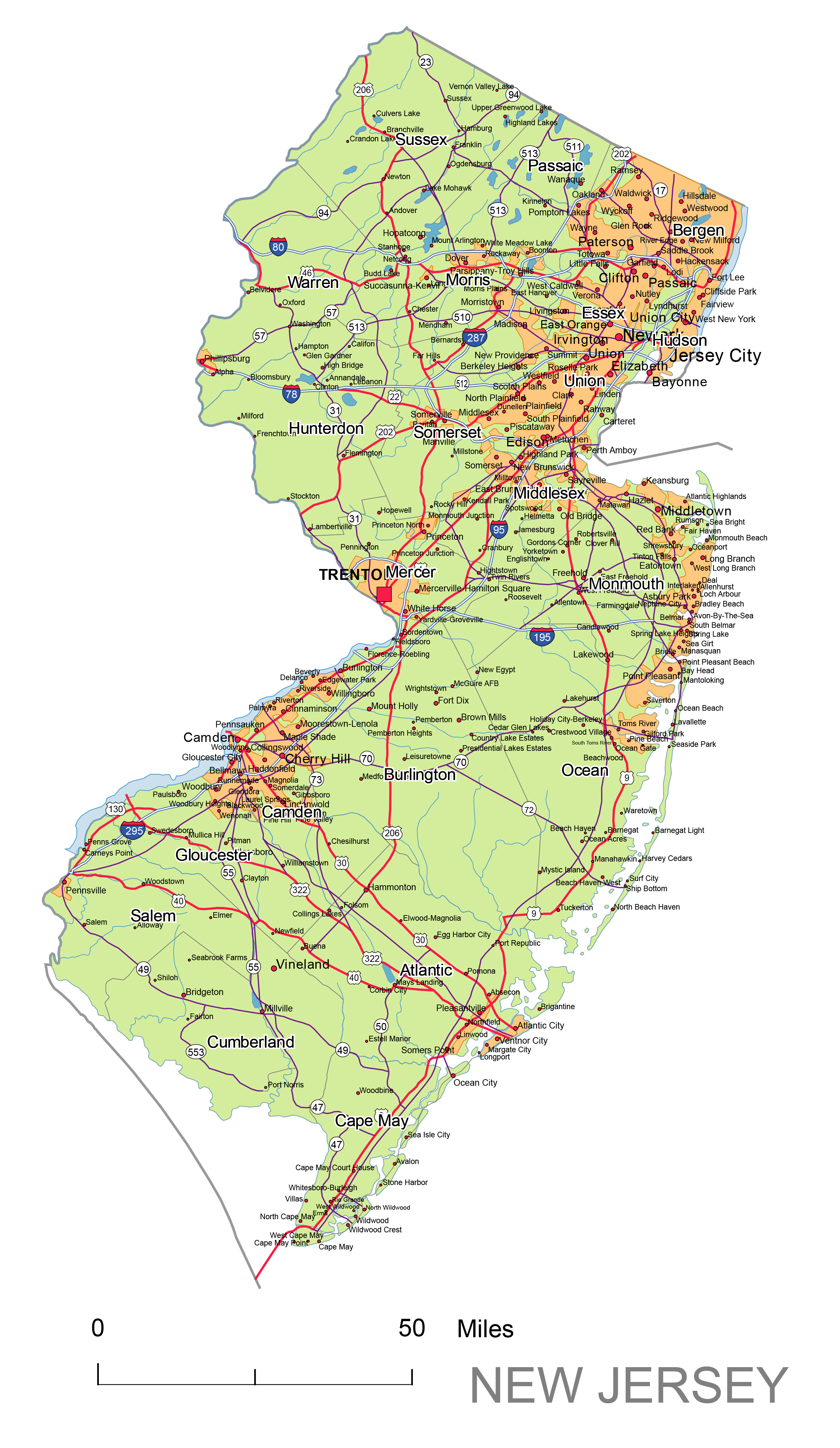

USDA money are backed by the us Company out of Agriculture (USDA) consequently they are designed to bring financial growth in a lot more rural parts. For this reason the latest eligibility of the house can be very important as the debtor. The fresh USDA also provides a current qualification map you can try to find out if the metropolis youre to order inside qualifies. They nonetheless do were particular suburban places that can have become as the history go out they upgraded the latest map. You will be astonished at just how many towns are eligible!

Your house being bought with good top personal loans Wisconsin USDA mortgage must also getting used as your no. 1 residence so you’re able to meet the requirements. It cannot be a vacation house or money spent.

And if your house is during a qualified venue, you will need to be considered since a debtor. You will find money constraints (together with according to your location to order) or other constraints. This type of money was booked for lower-money homebuyers exactly who might not if not be able to pay for a house.

USDA Home loan Processes

Outside of the qualification requirements, here is a straightforward summary of the USDA loan techniques your should expect with many mortgage lenders:

- Application-Fill in your loan software so you’re able to an excellent USDA-acknowledged financial. Never assume all loan providers is actually authorized so you’re able to procedure USDA loans.

- Economic Paperwork-Supply the lender along with asked monetary statements and records so you can confirm a position, money, credit score, an such like.

- Pre-Approval-The lender usually remark all your valuable guidance and, for individuals who qualify, provides you with a home loan pre-approval letter. This course of action takes a short while or as long as a week, but it is an essential action to be sure you qualify and you will also to inform you just how much domestic you can afford.

- Domestic Browse-Today, you could begin your residence search during the a good USDA-qualified area and commence while making offers.

- Appraisal-Once you have a deal recognized and you may technically start new closure processes, the lending company will order property appraisal to choose the newest fair-market price of the house. They do it to be certain the house is really worth the degree of the borrowed funds are approved. If you don’t, they are certainly not ready to make the exposure.

- USDA Acceptance-The lender will even send-off the loan document to your state’s USDA workplace, where it will need final approval on the USDA. This is yet another process that may take a short time or period a few weeks based on certain affairs.

USDA Home loan Acceptance

You to definitely important step to note a lot more than was #six. Here is the one-point in which an excellent USDA mortgage commonly disagree than just most other types of mortgages. This really is an extra step where in actuality the financing file is sent on the country’s USDA workplace getting feedback and you may finally approval. As a home client looking to a great USDA mortgage, you will want to funds particular longer because of it phase whilst will get offer this new closure techniques by several months at the very least (or actually many weeks, if things usually do not go given that effortlessly). Their bank will be able to give you a realistic schedule out-of what to expect as a consequence of each step of mortgage acceptance procedure.

If you’re to buy a house and you can believe that you and your neighborhood you’ll be eligible for a USDA home loan, get hold of your financial to get going into the application and you will pre-recognition processes. If you find yourself to order on qualified parts of greater Atlanta or even the close outlying counties, contact Moreira Class today to find out if a good USDA financing try good for you. We’re good USDA-recognized mortgage lender therefore we makes it possible to explore your entire a mortgage choices.