Casas puerilidade apostas com bônus puerilidade estatística grátis sem casa acimade 2024 Top apostas abrasado Brasil

December 26, 2024Play Ports Online for casino twin spin slot real Currency Us: Top ten Casinos to have 2024

December 26, 2024A method to Prepare for Being qualified to have a cellular Mortgage

AnnieMac Studies Cardiovascular system

If you are searching to have an alternative choice to old-fashioned homes, a mobile domestic tends to be perfect for your. Cellular residential property are cheaper than a timeless household without the need to sacrifice to your required have. Called were created property, these kind of house typically rates between $sixty,000 – $100,000.

A cellular house is good prefabricated house construction built on a good permanent framework which was constructed prior to Summer fifteen, 1976 (in the event the Agencies of Homes and you will Metropolitan Advancement began regulating the shelter away from are manufactured home). Mobile residential property are intended as effortlessly gone if for example the proprietor must transform urban centers.

Investment to have a cellular residence is a tiny different from investment a consistent house as many loan providers dont examine these homes qualified to receive very variety of mortgage loans. Mobile home loans need certainly to fulfill a certain band of standards due with the land in and that cellular house lay on. However,, not to proper care. It is possible to finance a cellular house we will mention afterwards payday loan Luverne.

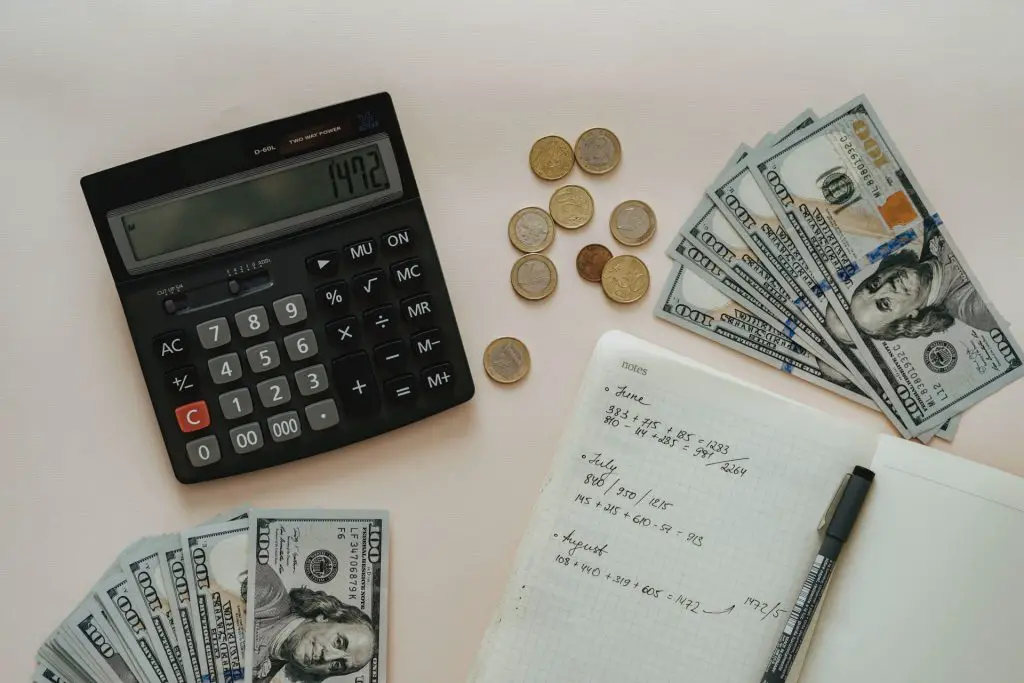

- Look at your credit score – your credit rating was a major factor that loan providers tend to imagine when determining whether or not to agree your to have a cellular home loan. When you have a leading credit score, might qualify for all the way down pricing and higher terms of many finance. Straight down prices could save you several thousand dollars along the life of your own mortgage, so it is crucial that you look at the credit rating before applying.

- Begin saving having a downpayment – it will always be good to see rescuing for a great deposit for your cellular house. Of many loan providers might require an advance payment with a minimum of step 3% of the mortgage, therefore rescuing now can help you afford the household regarding the future.

Particular Cellular Lenders

- Antique Finance: very lenders dont promote conventional money to have a mobile domestic because these structures are not subject to the safety standards established because of the HUD. But not, there are several Freddie Mac computer and you will Federal national mortgage association home loans you to definitely would promote official cellular home loans with really certain standards.

- Fannie Mae’s MH Advantage Program: allows customers to invest in a cellular house more than three decades which have low-down fee requirements but with rigorous conditions. Freddie Mac offers traditional fund to own cellular house for as long as they see most of the requirements.

- FHA Money: the fresh new Federal Houses Administration now offers lenders with fixed interest rates minimizing borrowing and you will deposit conditions. They offer are built mortgage brokers entitled Title We and you may Label II fund.

- Identity We: these can be employed to purchase cellular home yet not for the the brand new end in that they sit. The property need to be the majority of your residence, need certainly to see FHA guidance just before becoming placed on a rental webpages, and really should get in touch so you’re able to utilities.

- Title II: this type of loans lack one relationship with mobile lenders.

- Chattel Fund: These money are often used to buy different kinds of property, such as mobile fund. This type of finance routinely have faster terminology and lower financing limitations than conventional mortgages. Chattel Finance are a common investment option for mobile and are available homes.

To conclude

Investment a mobile domestic can seem to be challenging, but it’s you are able to. Before you decide to purchase a cellular house, research your facts and determine if this is the proper get for your requirements.

The brand new AnnieMac Guarantee

AnnieMac Mortgage aims to provide the ideal services for our consumers and therefore are right here so you’re able to reach finally your purpose of homeownership.

- 700 East Door Drive, Collection 400 Attach Laurel, New jersey 08054

Apply to You

American Society Home loan Greeting Organization LLC (dba AnnieMac Real estate loan, OVM that have AnnieMac Mortgage, Family Earliest A division regarding AnnieMac Mortgage, homecomings Mortgage & Security A department off AnnieMac Home loan), 700 East Gate Drive, Collection eight hundred, Attach Laurel, Nj-new jersey 08054. Lender NMLS ID# 338923. Western People Home loan Greeting Company LLC is not connected to or recommended by any state otherwise national organizations otherwise people entities backed of the exact same. American Neighborhood Financial Invited Team LLC keeps the next permits or approvals regarding the agencies down the page that allow it to behave once the a directly had shopping mortgage lender and you can agent.