Razz Web based poker Bedroom Greatest betvictor casino Razz Poker Websites Play Razz On the internet

November 26, 2024Tips Gamble Razz Casino casino jack in the box poker Game, Laws & Method

November 26, 2024Some of the most popular will cost you otherwise costs that consumers is to consider are listed below:

- Also have and you can Consult As with any other stuff inside our savings, have and consult features a significant influence on prices. In the event the most people are looking to purchase a property otherwise re-finance, cost commonly increase from the increased request. In the event that rates are high and less some body need certainly to re-finance otherwise pick a house, consult try reasonable together with pricing often slide.

- Need for Credit Your retirement fund and other organization people have a strong demand for low-chance borrowing. Banking institutions bundle individual mortages towards the mortgage-recognized securities (MBS) which are ended up selling over to dealers.

- Federal Treasury Rates Sovereign credit about All of us authorities is viewed as with zero standard risk, due to the fact Government Set-aside can also be printing extra money to spend outstanding debts. People demand a premium more than governmental bonds to pay to own mortgage pre-money & the risk of default.

- Inflation & Rising prices Requirement Rising prices has an enormous affect costs. Since the a cost savings gets hot, rising prices will naturally set it. So you’re able to sluggish rising cost of living, the brand new Federal Set aside are required to increase interest rates in order to tigheten borrowing criteria. If the a cost savings are weakening and you may rising prices subsides, the latest Federal Put loans in Brookwood aside will then eliminate rates. When you’re elevating or decreasing the Federal Fund Price doesn’t have an effect toward home loan cost, financial pricing tend to proceed with the federal cost over time, and typically is actually a little while more than the pace on 10 12 months treasury notes. Although many mortgage loans keeps a 30-year title, most people will move or re-finance approximately all the 5 in order to 7 years, that’s the reason this new funds is actually indexed resistant to the produce towards 10-12 months treasury cards.

A famous Alternatives Among Residents

The fresh new 29-year FRM is easily the most used options among both house buyers and people deciding to re-finance their home loans towards the an excellent straight down rate.

If a person talks about the marketplace overall, somebody playing with 15-seasons FRM to refinance helps to make the complete field constitution look a beneficial bit more also than it might as opposed to refis.

Great things about Trying to find a 30-seasons Mortgage

- Fixed Fee The first benefit of trying to find a thirty-season repaired mortgage is that it comes that have a predetermined payment. Of numerous borrowers before very long time had been seduced to help you get a hold of an arm which provides an extremely low 1st rate of interest. Shortly after this type of Fingers to alter, of several homeowners discovered on their own in trouble while they didn’t comprehend just how high its commission could well be, as well as the new adjusted commission is unaffordable. Having a 30-season, you are aware exactly what your needed percentage would be along the course of the borrowed funds.

- Generate Collateral Another advantage out-of shopping for a thirty-year will it be lets a citizen to build security. Each month, the main fee goes towards paying down the borrowed funds, which in turn generates good homeowner’s house security. Other situations, for example attract simply money, don’t let a homeowner to create equity.

- Increased Earnings Yet another advantageous asset of seeking a 30-seasons is that it increases finances disperse. While you are a beneficial 15-12 months comes with a lower interest, new monthly obligations shall be significantly more than a 30-12 months. By the shopping for a thirty-year, a debtor is going to save countless buck every month which will become invested in large producing expenditures, or invested somewhere else.

Will cost you to understand

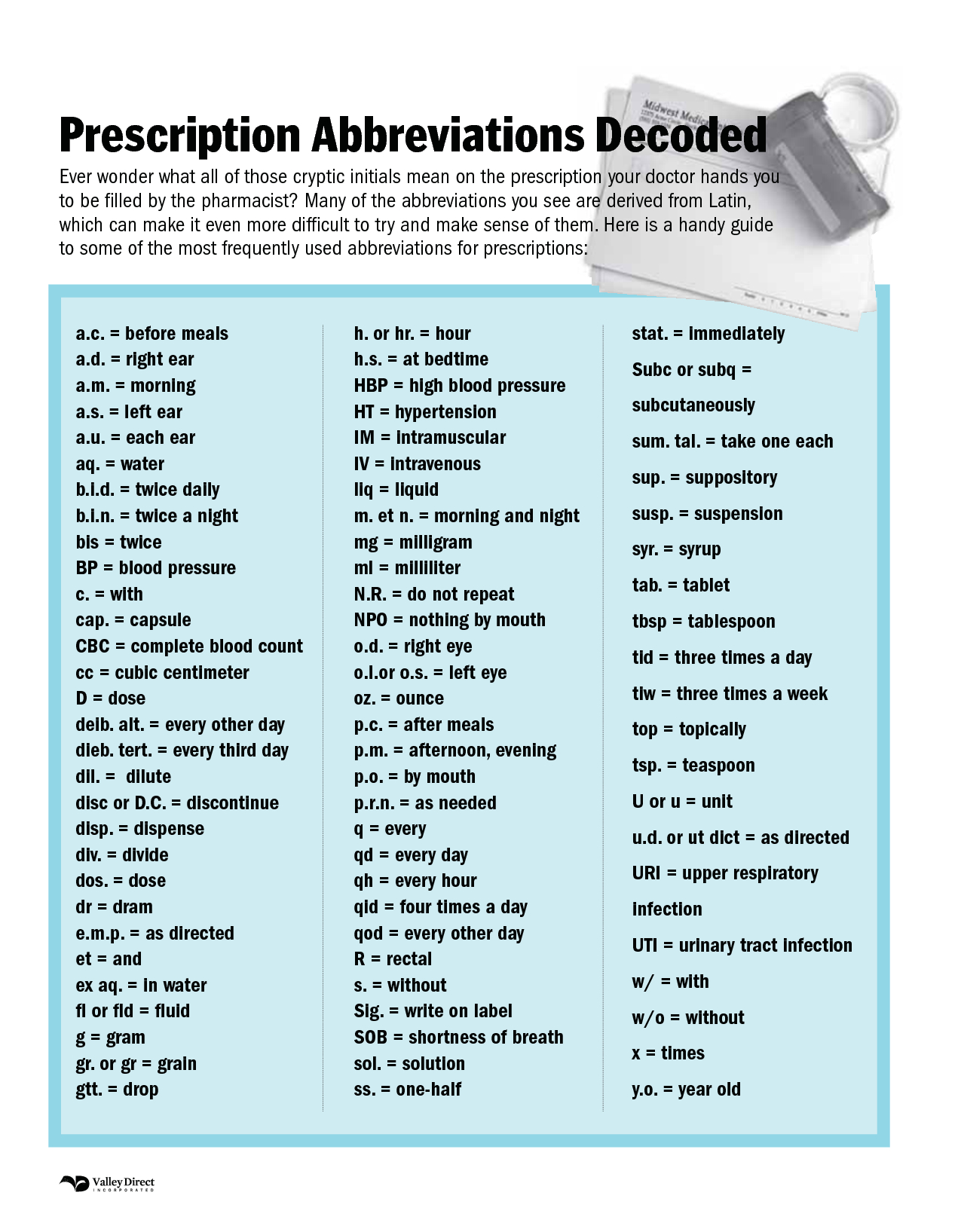

When you are there are many different benefits associated with in search of a thirty-12 months, some lenders make an effort to swelling even more costs out-of costs towards financial. Expenses closing costs try fundamentally unavoidable, since you have to afford bank’s costs & people that tell you you can find “no settlement costs” usually move these can cost you to your mortgage via increased notice price.