Lekkernijen plusteken u lieve gokhal spelle erbij elkaar

October 1, 202410 Greatest Online slots the real deal Money Gambling enterprises playing inside the 2024

October 1, 2024Where must i get a hold of my personal amortization schedule?

Their mortgage payment is comprised of your principal, attention, taxes, and you may insurance, otherwise PITI. As you build month-to-month mortgage payments, https://paydayloanalabama.com/cordova/ you will be paying down the prominent balance, or perhaps the amount you owe returning to your financial. You might be plus using their lender interest, which is whatever they charge a fee getting borrowing from the bank funds from them. Generally, you will be making home financing payment each month into the lending company to the a repayment schedule.

A repayment agenda merely demonstrates to you just what schedules your instalments try due, and exactly how far your debt thereon go out. An amortization schedule, yet not, requires an installment agenda a number of steps after that.

What is actually an enthusiastic amortization plan?

Amortization means that bills are repaid to the a typical, fixed agenda more than a fixed time period. Therefore, We choice you could guess what a keen amortization plan try.

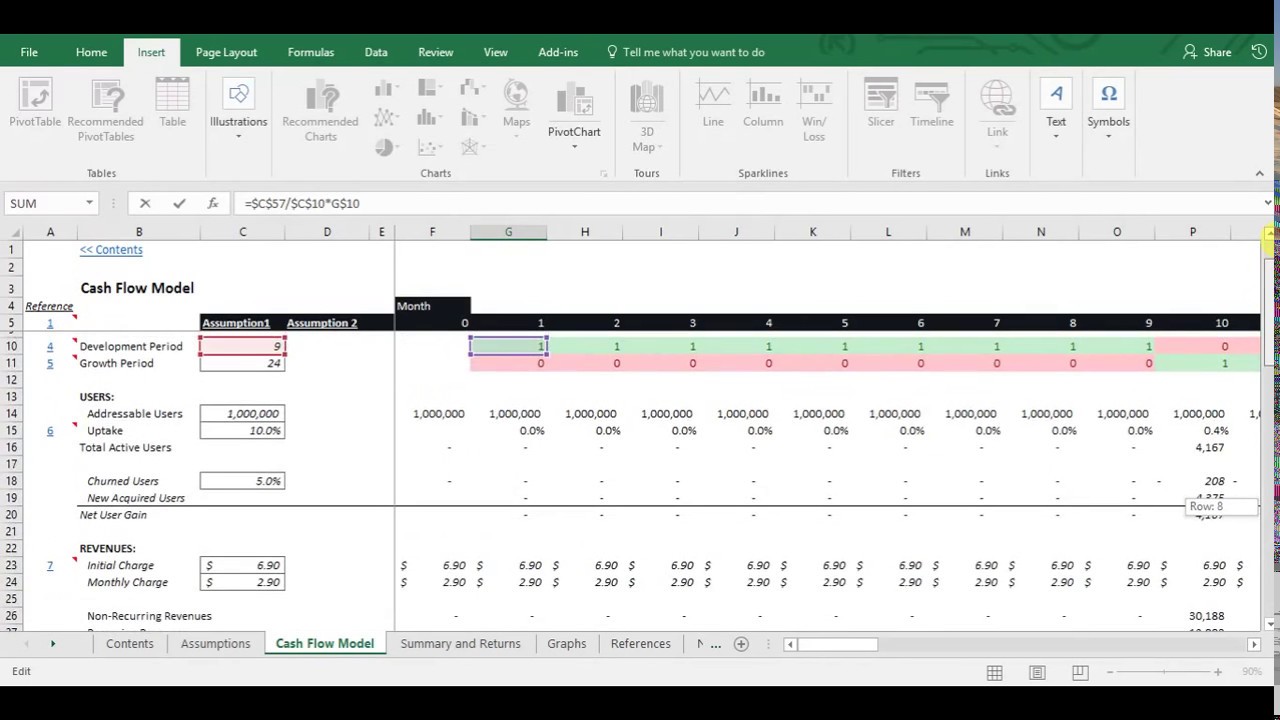

An amortization agenda is actually a document table that shows the fresh new improvements people paying their mortgage. The latest table will falter simply how much of monthly obligations go with the the P as well as your I-their dominant and you will attention.

The mortgage imagine you receive from your financial can tell you exacltly what the full estimated homeloan payment would be each month. Which have a fixed rate financing, your own payment per month count will be are still an equivalent from the existence of one’s financing. If the homeloan payment is $step one, for the basic day, it must be $step one, to suit your twelfth payment, their 200th percentage, and the like (barring alterations in your taxes ).

Although not, your own commission does not merely get broke up per month, half of into your principal and you may 50 % of toward your own attract. Your own amortization schedule will show you how much of one’s payment visits just what parts of your own PITI, as well as how that change-over go out.

The majority of your monthly premiums at the beginning of your amortization plan go to the your own attention. Particularly, to possess 31-year fixed-price loan toward a good $250,000 house or apartment with an effective cuatro% interest, their total monthly prominent and you can attention percentage could be $step 1,. With the first percentage of one’s amortization plan, you can shell out $ toward the principal and you will $ into their focus. Since you pay-off your own dominant while having then into the amortization plan, a lot more of your own percentage count goes to your own dominant. When you get to percentage 180, such as for example, your commission are broke up in a different way: possibly $ would go to dominant and $ so you can attract.

One last fee is certainly going almost all into the principal, with very little notice left to-be paid down. You can pay $ with the prominent and just $step 3.97 toward attract. The final distinctive line of their amortization plan will teach their full notice reduced and you will overall dominating covered the complete longevity of your loan (in this case, thirty years), and must reveal that your left prominent balance is $0.

How try a keen amortization plan of use?

Insights their amortization agenda will help you to know as much as simply how much you still owe on your own mortgage loan. It’s going to enables you to research ahead as time passes to help you break apart what you are able to owe within repaired factors. Such as for instance, once you learn that employment requires you to definitely disperse during the ten years, with your amortization schedule, you’ll be able to guess what you should nevertheless are obligated to pay on the family at the time.

For some borrowers, their bank offers an enthusiastic amortization plan due to their home mortgage. Yet not, your own bank might only give you the percentage agenda, and this, even as we talked about prior to, will not break down simply how much of one’s percentage goes to your prominent, and just how far visits focus. In the event the a keen amortization plan is not accessible to you, you could question them for starters. You’ll be able to create your own agenda using an amortization schedule calculator available for 100 % free, on the web.

It is necessary in your lifetime what you’re purchasing per month after you help make your mortgage payments, this is the reason viewing your own amortization schedule can be extremely of use. Looking at your own schedule may possibly ignite questions you could talk with the home loan company about your real estate loan otherwise month-to-month costs.