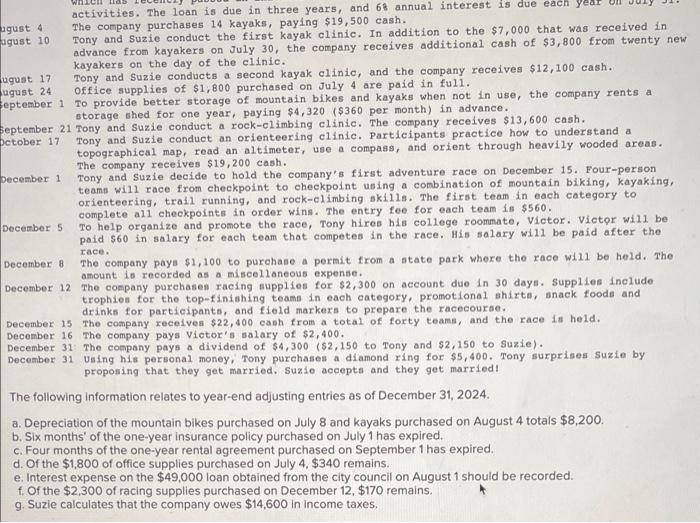

Paysafecard per Short message anschaffen auf diese weise geht’s Chip

September 12, 2024Gamble 250+ 100 percent free Roulette Video game inside the 2024 Zero Indication-Right up

September 12, 2024How to discover what my personal speed was?

Capture a few minutes to discover more regarding Annual percentage rate, to make sure you’re equipped with all the info you will want to proceed together with your preparations.

What exactly is an annual percentage rate?

Annual percentage rate or Annual percentage rate is the total price of one’s borrowing to own per year. Significantly, it provides the standard charges and you will appeal you will need to spend.

Imagine if you borrow ?10,100 more than three years to buy an auto. An apr of 5.5% would include their annual interest together with important charges payable towards the mortgage. Might upcoming spend 36 month-to-month money around ?301, totalling ?10,. This can include the latest ?ten,one hundred thousand you borrowed and you can ? when you look at the focus and you will costs.

Your repayments are identical every month due to the way the interest percentage is calculated. In the very beginning of the financing title, your payments will include much more interest but a reduced amount of the mortgage equilibrium. Towards the end of the mortgage title, your repayments will include reduced focus however, more of the mortgage balance.

What exactly is a representative Apr?

For those who seek financing, say with the an expense-assessment webpages, the different financing choices are often rated by representative Annual percentage rate.

The fresh clue is in the word representative’. Whenever that loan are reported that have a representative Annual percentage rate, it means one to at least 51% regarding users discovered a speeds this is the identical to, or lower than, the fresh associate Annual percentage rate however visitors from inside the 51% usually fundamentally obtain the exact same rates.

It could be easy to believe that the lender on the reduced associate Apr you notice said will give you the best rate. Although not, once you apply, it’s likely you’ll discovered your own age, large, or lower than this new member Apr.

Watch the films to own an easy article on Annual percentage rate. This may allow you to know financing pricing in more detail before you can acquire any money.

Therefore, what’s a personal Annual percentage rate?

After you submit an application for financing, it is likely that the interest rate you will get will be based towards the your personal facts. It requires into account your credit history and you will profit, together with amount borrowed and you can length of the borrowing from the bank. This is your private Apr.

You will need to realize it before you apply especially if you happen to be doing your research according to the associate APRs you get a hold of advertised.

New member Apr was a useful evaluation device, but not fundamentally the interest rate you get. In reality, it’s likely that customers becomes an individual Annual percentage rate though he is throughout the 51% which discovered a performance that is the same as, otherwise below, the brand new representative Annual percentage rate.

You may not know your personal speed up until once you’ve applied for a loan, and only implementing can impact your credit rating.

Simply because lenders will look at your financial history that have a cards resource department before carefully deciding whether or not to give you a beneficial mortgage provide, additionally the inspections was recorded on your own document. Once you sign up for a loan, the lending company should improve your credit reports.

For folks who lender around, we would manage to show what your personal loan speed is at the start before applying, without impact on your credit score.

Knowing your very own financing rates before applying could save you go out, which help you move ahead with your arrangements.

And then make some thing easy, for many who lender around, you can examine if the we could reveal exacltly what the personal rate is in improve on line or in this new Barclays software. Including, we possibly may currently have a provisional loan restrict in a what’s the best payday loan app position for you step one . Find out more.