The guy mutual brand new response from these readers, claiming for each features told all of us i literally saved their existence

January 14, 2025Gladiator Legends OLBG Position Review

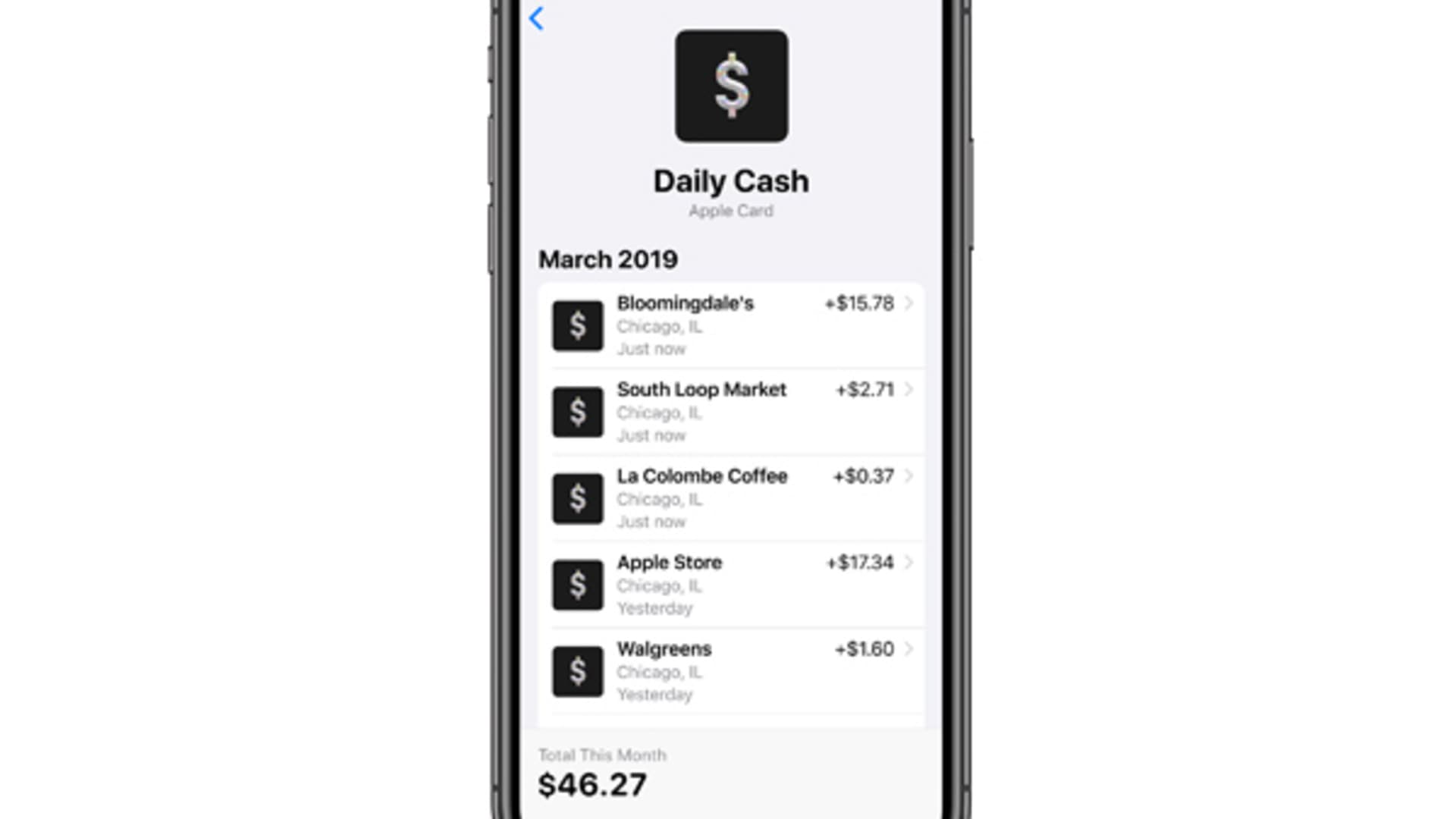

January 14, 2025Ally Lender – The app for all things currency

App store Ranks : 4.seven

Be it financial, investing, lenders or vehicle financing, absolutely nothing finishes you off starting right by you. Friend. Do it right.

Friend Financial – The software for everybody some thing money

And then make debt lifetime simple and easy safe happens to be our very own question. With ease control your bank, mastercard, dedicate, car and you can mortgage profile on the road – all-in-one software.

That have Robo Collection, pick one means, after that look for cash increased with no consultative commission, otherwise invest more cash in the business with a fee-based, market-centered portfolio

With Individual Information, start with a good $100,000 minimum for the assets not as much as proper care and you can discovered constant suggestions away from one faithful mentor for the assets – actually of these do not create

Coupons buckets and you will boosters are top features of the fresh Friend Bank Discounts Account. Paying buckets is actually a feature of one’s Friend Financial Purchasing Membership

Early direct deposit, a component of Friend Bank’s Using Membership, offers eligible head places up to 2 days ultimately

Ties services and products considering using Ally Dedicate Securities LLC, member / . Having records for the Friend Invest Ties see brokercheck.finra.org/firm/summary/136131. Advisory characteristics offered by way of Friend Purchase Advisors Inc., a registered investment agent. Ally Financial, Ally Invest Advisers, and Ally Purchase Bonds is wholly possessed subsidiaries from Friend Economic Inc. ally/invest/disclosures/. Ties items are Not FDIC Covered, Perhaps not Bank Guaranteed, and will Beat Worthy of

Ally Purchase does not charges earnings having carries and you may ETFs valued $dos and better. Stocks cost lower than $2 are energized a bottom fee up to $4.95 along with step 1 penny for each and every express towards whole purchase. Pick friend/invest/commissions-and-fees/ to find out more

Learn more Neobanks

A neobank, known as an on-line bank, digital lender, or adversary bank, is a type of lender that operates solely online without traditional bodily department systems. Neobanks power modern technology to provide numerous financial functions, typically because of cellular programs and you will web systems. Listed below are some key properties and features of neobanks:

- Digital-Simply Presence: Neobanks jobs completely on the web, without actual twigs. People relate solely to the lending company using digital systems including mobile applications or websites.

- User-Amicable Interfaces: Neobanks run bringing seamless and you may intuitive member online payday loans Mississippi experience. Their platforms will feature sleek designs and simple-to-browse interfaces.

- Reasonable Charge: Many neobanks give straight down charges versus conventional banks. Including shorter if any costs for account fix, overdrafts, and foreign deals.

- Imaginative Properties: Neobanks often provide innovative economic features and you may devices. Including genuine-date using notifications, cost management products, offers requires, and complex analytics to track investing models.

- Accessibility: With 24/seven supply thanks to electronic platforms, neobanks promote highest benefits having users, allowing them to carry out its money from anywhere at any time.

- Small Account Beginning: Opening an account which have good neobank is normally an easy and you will straightforward processes, have a tendency to requiring not all minutes and basic personal data.

- Run Specific Areas: Certain neobanks address specific consumer avenues, eg freelancers, small enterprises, otherwise tech-savvy people.

- Partnerships which have Traditional Finance companies: Specific neobanks partner which have oriented loan providers giving certain qualities, ensuring regulating compliance and you can stability.

Neobanks are part of the wide fintech (monetary technology) revolution, leverage technical so you can interrupt conventional banking habits and gives far more custom, successful, and you will obtainable financial features.

Ally Financial utilizes individuals funds models to make money, often leveraging its electronic networks to keep operational will set you back reasonable. Below are a few preferred ways neobanks make money:

- Interchange Costs: Neobanks earn money from interchange charge whenever consumers fool around with the debit notes. Each time a buyers decides to buy something, the retailer pays a tiny fee for the financial that given brand new cards.