FaFaFa Slot Remark Enjoy FaFaFa on the web slot, Bookie Reviews

January 12, 2025Honey Honey fafafa position websites Honey Condition Trial from the Pragmatic Play 96 5% RTP 2024

January 12, 2025Improving CRA Loans Steps: Enhancing Neighborhood Reinvestment Operate

In the home loan banking surroundings, area reinvestment efforts are pivotal when you look at the fostering reasonable credit methods and you may producing monetary growth in underserved portion. The community Reinvestment Operate (CRA) serves as a cornerstone within plan, guaranteeing loan providers to meet up with the credit need of teams in which they perform. Promoting CRA credit is actually a regulatory specifications and you will a proper possibility for lenders to exhibit the commitment to community development and you will grow their markets come to.

Wisdom CRA Credits

At its center, town Reinvestment Operate will address disparities in the the means to access borrowing from the bank and economic properties certainly reduced-and you can modest-money communities and you may communities off color. The CRA tries to help you stimulate economic increases, do jobs, and promote reasonable casing efforts by guaranteeing banking institutions or any other economic establishments to purchase these types of communities.

Financial institutions earn CRA credit using individuals products contributing to community innovation, together with mortgage lending, small company credit, area innovation financing, and you can expenditures into the affordable houses systems. Such credit are very important for financial institutions to exhibit compliance with CRA regulations and will seriously feeling its show studies of the regulatory providers.

HLP’s FaaS Choice getting Maximizing CRA Loans

House Credit Pal (HLP) even offers imaginative choice using their Fairness Just like the A support (FaaS) platform, that is made to help mortgage brokers enhance their CRA borrowing from the bank measures and improve its society reinvestment efforts.

Report on HLP’s First Research CRA Equipment

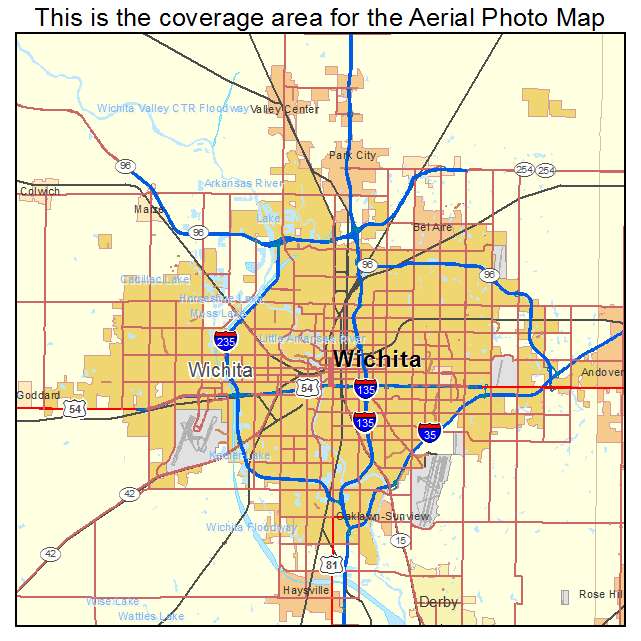

HLP’s Very first Browse CRA device provides loan providers which have an extensive study of their financing portfolio, identifying financing that may qualify for CRA loans based on the geographical distribution out-of consumers. By the leveraging research statistics and consolidation having existing Consumer Relationship Administration (CRM) or Financing Origination Solutions (LOS), loan providers normally efficiently pick opportunities to maximize its CRA loans when you find yourself making certain conformity with fair financing guidance.

Addition to help you HLP’s 2nd Research Dash

And determining CRA-eligible loans, HLP’s Next Search dashboard also provides information towards other businesses, such as advance payment direction and you will basic-big date homebuyer apps, that may after that help community advancement attempts. By the streamlining the entire process of pinpointing and you can helping varied individuals, loan providers can also be build the means to access homeownership options and sign up for revitalizing underserved groups.

Caring and you may Storage that have HLP’s Light-Labeled App

HLP’s white-branded app try loan places Cottondale a powerful equipment getting enjoyable and you can nurturing possible individuals just who may need more hours becoming ready to pertain for a home loan. Owing to have eg household searching, to acquire power computation, borrowing from the bank improving, and you may obligations-to-earnings ratio formula, individuals takes proactive methods to your homeownership. Meanwhile, lenders acquire beneficial understanding into race and ethnicity fashion. Because of the caring relationships with your applicants, lenders increases its pipe out-of varied borrowers and you will boost their neighborhood reinvestment work.

Addressed Services for Targeted Ad Techniques

HLP has the benefit of addressed properties to have thought and you may executing focused offer techniques for lenders seeking to boost the amount of diverse candidates. Of the leveraging analysis statistics and you will industry information, lenders can be efficiently arrived at underserved teams and you will interest prospective borrowers who could possibly get be eligible for CRA credit. Contracted out business jobs so you’re able to HLP lets lenders to focus on the key organization circumstances whenever you are increasing its effect on neighborhood advancement.

Tricks for Promoting CRA Credit

- Incorporate HLP’s tools to help you improve CRA conformity processes and you may choose potential to possess increasing CRA credit.

- Influence data understanding to help you effectively target underserved organizations and you will tailor revenue operate to meet their needs.

- Feature CRA credit optimisation into total business strategies, aligning community reinvestment services having business goals and objectives.

To close out, promoting CRA credit is not just a regulatory specifications as well as a strategic crucial for mortgage brokers trying show the commitment to society invention and you may fair financing techniques. From the leveraging imaginative alternatives such as HLP’s FaaS system, lenders is streamline their CRA conformity process, build accessibility homeownership ventures, and you may subscribe the commercial efforts regarding underserved groups. As we look to the ongoing future of financial banking, enhancing neighborhood reinvestment operate will stay essential for driving sustainable progress and you can fostering inclusive success.

Discuss just how HLP’s FaaS options may help your institution maximize CRA credits and you can optimize area reinvestment work. Call us right now to find out about all of our creative products and you will managed attributes to own mortgage lenders.