Best Payout Online casinos 50 free spins on buffalo no deposit in the us 2024 97%+ RTP

December 10, 2024Fantastic Four Slot machine around the world slot free spins game to try out Totally free

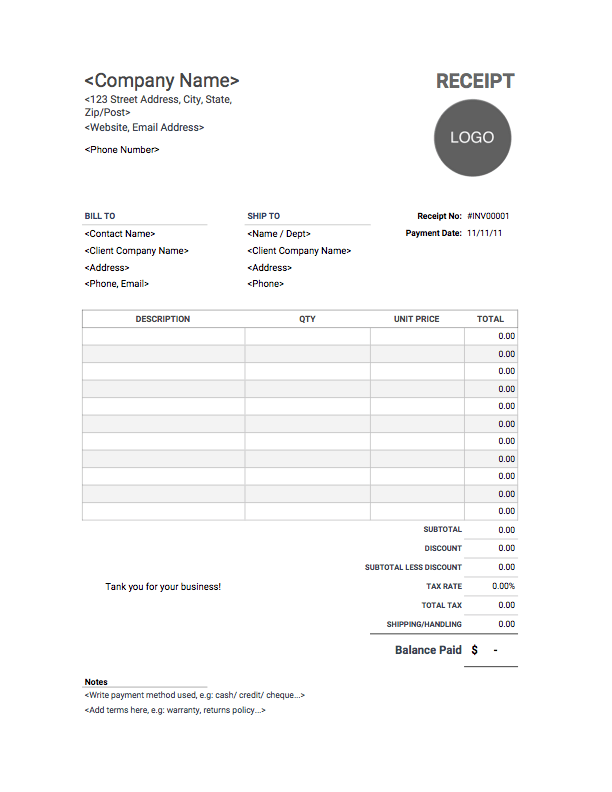

December 10, 2024Control your financial payments eg a supervisor

To invest in a property try a button milestone that you experienced home financing is probably the premier financial commitment you can actually ever build. Also, it is a long-name mortgage, that may elevates so long as 2 decades to invest away from.

For those who manage your home loan very carefully, yet not, it can save you profit the long run and give yourself alot more choices once you 2nd you desire borrowing from the bank. To learn how this work, you need to understand how the loan repayments is actually prepared.

How mortgage repayments work

The common lifetime of a home loan try twenty years of the sized the loan, the latest stretched commission term will make it inexpensive. There might be as much as cuatro components towards the month-to-month commission, however, dos was simple on the lenders: your own first instalment and you may a help commission. Strengthening insurance rates and you may Borrowing from the bank Life insurance coverage premium may additionally function part of your own commission.

The largest component will be the basic instalment, and it’s really here that make the most differences to help you how far the loan ends up costing your. For each and every basic instalment consists of a funds piece and you may an attraction section. Appeal towards home financing is determined daily with the remaining money balance. When you begin settling your property financing, the administrative centre owed remains very high, and so the attract bit is the reason a serious fraction of your own first instalment, compared to matter deducted from your capital harmony.

The low your financing equilibrium will get, the latest shorter attract you have to pay every month. Demonstrably, quicker you could reduce the resource amount owed, the fresh less desire you are going to spend along the name of your own financing. you will pay-off your home loan less, which then allows you to put your previous mortgage instalments towards a special financial support.

Here are some ideas to the dealing with your residence loan instance an effective boss:

- Create all of the financial fee on time to safeguard your own borrowing from the bank get.

- Many reasons exist not to skip an installment into an effective loan: in the first place, it makes your property mortgage be more expensive in the attract, because your resource harmony was not reduced in that fee years. Overlooked costs in addition to destroy your credit score and remain on your personal credit record for up to a couple of years so that they destroy your ability to find borrowing later.

Investing additional to your thread helps make financial experience

If you can be able to spend more minimal instalment on your financial per month, you will save money in the near future and unlock this new worth of your home. You could change it towards a valuable asset that helps you see the much time-identity monetary requirements.

When you spend more the desired matter, the extra fee doesn’t wade on attention: alternatively, it minimises your money balance faster. You to definitely subsequently decrease the expression of your financing, helping you save a lot of money into the focus. You can make use of the Nedbank Financial Fees Calculator to see the difference paying over minimal tends to make.

As an example, let’s assume you buy a house to have R1.5 million, putting off a great ten% put off R150,000 and taking out fully home financing to have R1.thirty five billion more two decades, in the mortgage loan regarding 8.5% a-year. Your own minimal payment might possibly be just more R11,five-hundred more than 240 days, one to adds up to a total of R2.76 mil.

But if you can afford to pay just R1,600 a great deal more monthly, making the instalment to R13,100, you’ll be able to pay-off the mortgage in 15 years and you will save up to R400,000.

More money raise your security smaller

Equity is the difference between what your house is value and you can the quantity you Georgia title loans near me continue to are obligated to pay involved. Purchasing even more in the home loan was a method to improve your collateral shorter, and you can borrow against one to guarantee once you 2nd you prefer borrowing. If you decide to sell the home and you may you’ve been and work out additional payments frequently, the loan amount you nevertheless still need to pay off is lower, you should be able to change the elevated security for the cash to place to your second household.

An easy way to shell out more into the mortgage

This tunes easy in theory, however, we know you to definitely about difficult times we are all supposed through, locating the more income to place to your home loan is be difficult. You may want making specific sacrifices, however, exercising what kind of cash it can save you is superb inspiration.

Test out your current funds. Whenever past do you inform your monthly family budget? You may find expenses you might skinny, or intend to crack crappy models one ask you for currency. An area-hustle might assist improve your income.

When you yourself have an untouched cottage at your residence, you could potentially renovate they and you can book it for additional earnings. When you get an annual salary increase, is actually staying with the fresh finances you’d before, so you’re able to put your entire boost to your house financing percentage each month and not miss they. In the event the rates of interest fluctuate plus payment per month try quicker, keep make payment on former number. All little bit facilitate.

Even though you can not do it each month, spending most into the home loan as much as possible commonly nonetheless rescue you some funds. Should you get an annual extra of working otherwise discovered a good taxation rebate, putting it in the financial leads to a healthier avoidance on your own financial support equilibrium.

In the event the mortgage has a rotating credit business, thought going the emergency deals into the thread because a lump sum, whenever you are however and work out normal financing money. You can always availableness this type of finance if you’d like all of them, however, until then, they’re going to reduce your funding balance owed additionally the notice you can easily become billed.

Get 1% cash return to your an excellent Nedbank mortgage

Nedbank try committed to and come up with home ownership a real possibility. Did you know that normally, Nedbank pays aside to R1.8 mil a month in cash back to the mortgage brokers? During the 2023, i paid over R20 million inside cash return with the lenders. To have an easily affordable mortgage designed towards the activities and cost-added items particularly up to R20,000 money back and you can a good 50% discount on your own attorneys thread subscription charge, buy the bank that is perfect for your bank account.

- How to definitely never miss a loan payment is to arranged an excellent debit purchase to spend the new amount due on a single time as your income is paid back into the membership. It’s also possible to created repeated money via the Nedbank Currency application or On the internet Financial.