Gamble FreeIGT Goddess Slot Games: Need to Play On the sticky diamonds slot web Pokies Server

November 3, 2024Pros and cons away from Sc Family Guarantee Finance

November 3, 2024And therefore Mortgage lender is the best for You?

Mortgage loans Explained

A mortgage style of makes reference to even though a national agency guarantees the home loan. Their financial title is the restrict amount of time the financial lasts. Think of, your month-to-month mortgage payment depends on the house or property taxation, home loan insurance policies, homeowners insurance or any other costs you can happen.

Style of Mortgage loans

Check out well-known home loan designs and you can conditions to possess potential homebuyers. Think about, financing approval depends on various some thing, such as the purchase price. At the same time, their month-to-month earnings is certainly one a portion of the process because the these financing helps it be simpler or more complicated to acquire recognized based on your credit score or any other situations.

Old-fashioned Mortgages

A conventional mortgage are home financing this is not supported by the fresh new authorities. Conventional mortgages constantly want highest credit scores than simply a government-supported financial. Likely to generate a down payment off lower than 20%? You may have to pay money for mortgage insurance too. Mortgage insurance is insurance policies one to covers a loan provider in the event the a debtor stops using on a home loan.

FHA Mortgage loans

Personal loan providers render FHA mortgage loans. The Government Homes Management establishes the guidelines for those mortgages and you will helps ensure all of them. These types of mortgages keeps apparently lower credit history requirements and you may be able to make a https://paydayloansconnecticut.com/bethlehem-village/ deposit only 3.5% if you be considered. You ought to pay money for financial insurance if you get an FHA mortgage.

Va Mortgages

Va mortgages let most recent service professionals, experts and you will specific partners buy home. The new Agency away from Pros Items manages such mortgages and you may backs them, but personal lenders provide these money. Virtual assistant mortgage loans typically have no deposit specifications no financial insurance policies requirement.

30-Season Repaired Mortgage loans

A 30-season fixed-rate mortgage lasts for 3 decades. You could potentially automate the method if you make additional money. The repaired price relates to your home loan rate, hence stays the same into life of your home loan. Your own monthly payment stays an identical, too.

15-Year Fixed Mortgage loans

An effective fifteen-year fixed-price home loan lasts for fifteen years. This is why your monthly installments are more than they’d become getting a 30-year fixed-speed home loan. You pay smaller from inside the attention across the lifetime of the loan.

5/1 Arm

A supply is an adjustable-rate home loan. Due to the fact identity means, Possession have an interest speed one to transform. Loan providers alter the rates in response so you’re able to economic climates. These mortgage loans always initiate within a predetermined price. An effective 5/step 1 Case has an effective 5-seasons period which have a predetermined speed. Next, lenders can change their rate of interest once annually. Thus your payment per month might go upwards otherwise down also.

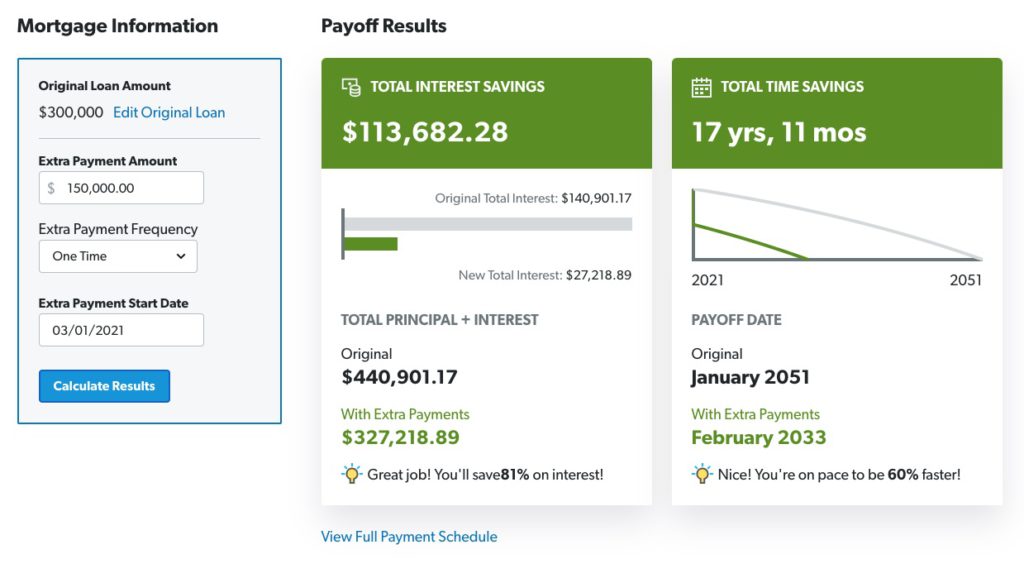

Every person’s state varies. The mortgage that is right for example debtor may not be best for the next. Rating several rates, review all of them cautiously and you can match the borrowed funds that is true having your. Discover additional initial will set you back and home loan preapproval laws and regulations depending on the product while the bank. You need mortgage hand calculators to understand which loan is the best to you, but you also want to adopt average mortgage cost or any other related can cost you as they possibly can are different.

Use a home loan calculator otherwise value calculator to help you reason behind something such as possessions fees, private financial insurance policies, homeowners insurance, etc.

Since you go with the best style of financial, you also need to select a lender. Below are a few points to consider since you see prospective lenders:

Reputation

So is this a lender the ones you love otherwise family been employed by with? What kind of knowledge has that they had? What type of ratings does the financial institution provides? Is there issues into Better business bureau? Just how was indeed men and women grievances addressed? Look for a lender that have a strong reputation. You have their level of exposure endurance. Just remember that , mortgage debt try secure with a very solid bank.